In May We Remember Veterans and Active Duty Service Members we have heard from who Sacrificed for Us and Legal Updates

Categories: MilitaryMay 28, 2025

Views: 919

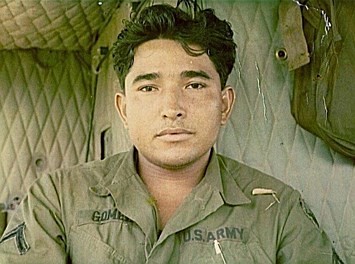

Leo Gomez, two Purple Hearts, a Bronze Star, Vietnam Veteran

August 3, 1947 – November 2, 2018

Leo reached out to us late September of 2018, with only 30 days left to live, worried about his wife being responsible for a $26,000 timeshare loan. He had been upgraded, told that because his resort had been acquired, he had to convert to the new points. That was not true. When we asked Leo if his sales agent had been aware of his pancreatic cancer, he said yes, “I told him that was why I was so tired.” A volunteer filed a complaint on Leo’s behalf with the Arizona Attorney General, because we had received several complaints about his Las Vegas sales agent. The resort responded that they would cancel the loan, given the circumstances. A few weeks later Leo’s wife called hysterical. Leo only had hours left to live and Barclays was calling demanding their down payment. The resort canceled his loan, but did not reverse the down payment. Given the circumstances, she did not have the strength or stamina to fight Barclays. Our volunteer spoke to Leo eight times in October, as he also battled his timeshare transaction.

https://www.dignitymemorial.com/obituaries/glendale-az/leopoldo-gomez-8043517

Danny Wolfer, Vietnam Veteran

February 7, 2025

https://www.beanandsonsfuneralhome.com/obituaries/danny-wolfer/#!/Obituary

According to Danny, a Vietnam veteran exposed to Agent Orange: In Las Vegas, on March 7, 2016, our sales agent told us we would not have to pay maintenance fees if we purchased more points. He blamed other people that had sold us points, but “We can get you a deal for $3 so when you go to sell them they are going to be a lot more and that will offset your maintenance fees. This might be tough for you, but it’s the best way to not have to pay maintenance fees.” He said we were special people. We learned our points had no resale value.

Maintenance fees were $10,000 a year. Our sales agent explained, “You will pay $2,500 a month for ten years and then you will be paid up and there will be no more maintenance fees or loan payment. Then the little people will be paying for your vacations.” This was not true.

They mailed our package, so I was not able to review the document. We were fraudulently upsold, losing a total of $170,000. I received a 1099C issued for $170,000 which I was able to dispute after contacting a volunteer. We had paid a lot of money for prior points. I had just been in the hospital for congestive heart failure. My blood sugar was at 400.

Our volunteers received 24 complaints against this agent from 2016 to 2018. In 2018 the sales agent filed a lawsuit against Diamond admitting he created reasons or problems why existing members had to buy additional points. He earned $2.4 million two years in a row.

Veterans and Active Duty Service Members, and other PodTV Guests

Many active duty service members that have been pressured into buying a timeshare with future financial commitments are in danger of losing their security clearance should they default.

PodTV’s April – May Timeshare Solution or Surrender, with co-host Kim Calhoun. All shows can be accessed by scrolling to the bottom of the homepage and click Live Update.

April Episodes 58 – 61 and May 62 – 65

Joanne in New York, Nelson is a Marine veteran, 100% disabled, Episode 62

We maintained a blemish free credit score our entire married life but were forced to default on our timeshare loan after realizing that our sales agents fabricated a cash-back program on October 27, 2021. We purchased 17,500 US Collection points for $57,400 to become Platinum members. The sales agent and manager told us that at Platinum level, we could redeem points for cash up to $15,000 if we used our points to purchase Diamond Luxury items, as points would be redeemed at $.10-.30 per point. They said the funds could be used to pay maintenance fees or we could pay off our loan in three years. The sales agent showed us his in-laws account where they were refunded $5,000. Another member recorded this sales agent a few years ago explaining the same fabricated program. We learned the sales manager has a criminal history that includes robbery.

My husband Nelson can no longer travel due to his medical condition caused by Agent Orange exposure in Viet Nam. He has heart disease with congestive heart failure, seven stents, a defibrillator, and has gone into ventricular tachycardia three times. He has diabetes with stage 3b kidney disease, skin cancer, severe sleep apnea requiring oxygen and was diagnosed with lymphoma in 2023. He went into ventricular tachycardia for the third time in January 2024.

Hilton Grand Vacations acquired Diamond Resorts. HGV MAX is the program Diamond members are eligible to sign up, to be able to access Hilton properties. Before Nelson’s symptoms worsened, we upgraded to HGV MAX by buying a Hilton deeded week for $62,991, counting on the cash from the buy-back program to pay for the purchase. When we inquired, we were informed that there is no such program. I called our sales agent to ask why we never received this money. He said we would see it at the end of 2022, then stopped answering our calls. I called the manager. He said that we signed the contract and should have known better.

Since we can no longer travel, we reached out to the timeshare industry lobby, ARDA, three times and were advised to sell our points, but Diamond points have no resale value. Licensed brokers, that don’t charge upfront, will not accept a listing due to excessive restrictions on the use of secondary points. When I mentioned this to ARDA, there was no response.

In 2016 we first purchased 7,500 US Collection points, then made four subsequent purchases. We have two outstanding loans. The second loan was for our fourth upgrade in Orlando in 2021

In 2023 Sam Carradice responded: The purchase documentation forms the entire agreement between yourselves, and we hope that you can appreciate we are only able to rely on this documentation which you signed to confirm your understanding.

Jon, a Florida resident and an active duty Army Warrant Officer 1

We learned that there were multiple black-out dates and no dates that would coordinate with my military schedule. Access to the booking site comes after the contract rescission period expires. Once we had access, we learned that booking a stay requires booking months in advance.

Jon’s statement above does align with what other service members have reported. Jon was a past guest on PodTV, fortunately able to resolve his dispute.

Jay in Texas, Episode 64, never used his Wyndham points due to frequent deployments, some with little advance notice making booking six to nine months out unfeasible. Wyndham has not responded to Jay’s demand for a 6% interest rate available to service members while they are deployed.

Brett in Utah, Episode 62, a 100% disabled combat Army veteran and a Wyndham member for many years. He was encouraged to rent to cover the cost of the timeshare, but the value was nowhere near what Brett said his sales agent claimed.

An Alternative to perpetual high-cost timeshares

To end on a positive note, on Episode 65, we learned about Vacation Ownership Advisor, our consignee at MyRESORT Co Op offering support services for an alternative to perpetual contracts, high interest rate loans, and Travel Clubs that demand the purchase of a Travel Club to “get you out of your timeshare” – that likely results in the burden of the Travel Club AND the unwanted timeshare. The IT nuts and bolts expert, behind the scenes, Taylor, joined us as well. https://volqa.com/

Lyndsey in North Carolina, also on Episode 65, shares her timeshare disaster. We asked Lyndsey to help us learn more about MyRESORT Co Op. In spite of a timeshare purchase gone bad, most still would like to travel and book condo-type resorts.

According to Lyndsey, We reached out to Hilton asking to have our most recent purchase canceled. We had no choice but to default. We stopped making payments in December of 2024. I filed with the FL and NC Attorneys General, the BBB. The North Carolina AG said Bluegreen has a different opinion of fact. My next step is to reach out to the media

Our first purchase was at a promotional stay at a Bluegreen Myrtle Beach Preview Center on August 19, 2023. The person who booked the stay said that there was a children’s room. When we arrived, we were informed they do not accept children in diapers. Our boys are diagnosed autistic and were not potty trained. They should have asked about their ages. They had to sit through a 5.5-hour presentation. We were told since we took the trip we had to attend. The kids had a meltdown, so we signed as quickly as possible for a trial package of 6,000 points for about $17,500. We financed $15,750 at a 15.99% interest rate.

The saleswoman indicated this was a financial investment that would increase in value. She confirmed that If we wanted out, there was a way to do so. She said, “Of course, Bluegreen wants to help. There is an exit program if you decide this is no longer for you.” She did not explain that there could be no loan.

Our second purchase, November 11, 2023, was at an Orientation in Myrtle Beach. Sales agent Robb told us that he would be our personal “owner relations coordinator” before he retired. He shocked us by informing us that 6,000 points is not enough to stay in a 2 BR. “I’m really not supposed to say this, but since Bluegreen is getting bought by Hilton, you need to purchase points to be grandfathered in or your membership will be useless with Hilton owners having access to Bluegreen. I later learned this wasn’t true. He gave us 20 minutes to discuss. The other agent scoffed at us saying that we would not be able to book a 2 BR until we exceeded 10,000 points. A long time Bluegreen owner looked up a Boyne MI 2 BR week we could book, white or blue season. The Fountain’s in Orlando, red season, was 1,500 points a night.

Rob brought up the Bluegreen Rewards credit card saying we could use Rewards Points to cover our closing costs, down payments, or maintenance fee. We learned that Rewards Points do not cover much. We purchased 9,000 additional points for $19,040.

On November 10th, 2024, at Bluegreen’s Carolina Grande Resort in Myrtle Beach, we attended a review to go over the changes due to the Hilton buyout. This agent laughed and said, “Now I know why I was put with you guys! You’re newbies!” He said that owners who did not “evolve” lost their entire investment because weeks became worthless. He said, “How could you afford not to upgrade? You will not be able to sell what you have down the line.” He explained that Bluegreen members must make an “eligible upgrade” in order to book at Hilton resorts. We had been told at our prior purchase that we would be grandfathered in by that upgrade.

Rob said our credit scores are amazing so we could easily get a loan at a lower interest rate, and he has helped others do this for years, “Companies will be begging you to borrow money”. We were to reach out to him in two weeks, past the rescinding period. We purchased an additional 6,000 points for $16,500. We financed $11,950 at 11.99%. Rob had no intention of helping us refinance our loan.

Legal Updates

Attorney Jay Kumar, Episode 63, explained a Mass Arbitration effort that is underway against Wyndham.

SMITH v. WESTGATE RESORTS – DEFENDANT’S MOTION FOR SANCTIONS

In March we reported Westgate Resorts moves for sanctions as follows:

This case is just one of over sixty frivolous, often time-barred, cookie cutter lawsuits that Plaintiffs’ counsel, or her firm, The Timeshare Law Firm, has filed, which are devoid of merit and demonstrate a blatant disregard for Rule 11’s requirement of a reasonable pre-suit investigation. These cases involve different timeshare companies selling different timeshare products at different times to different purchasers. Even a superficial investigation, much less one that is compliant with Rule 11, would have shown that the complaint filed presents claims that are clearly time-barred, relies on law that is plainly inapplicable, presents causes of action that are plainly not actionable.

On 5-21-2025, Attorneys for Defendant Hilton Grand Vacations filed the following motion involving The Timeshare Law Firm, John Abrams

UNITED STATES DISTRICT COURT MIDDLE DISTRICT OF FLORIDA – ORLANDO DIVISION

RICHARD SMITH AND JUSTYN SCARBEAU, Plaintiffs v. Case No. 6:25-CV-00218

HILTON GRAND VACATIONS, INC. Defendant

(Excerpts) PLAINTIFFS’ RESPONSE TO THE COURT’S ORDER TO SHOW CAUSE

On March 31, 2025, the Court issued an Order directing the parties to proceed to Mediation and to file a Notice of such within fourteen days (14) of the Order. Due to an oversight of the docket, an influx of cases, vast internal changes, as well as unforeseen and sweeping resignations, Plaintiffs failed to timely initiate mediation scheduling. As of May 7, 2025, due to previously referenced issues within the Plaintiffs’ instant office, Plaintiffs’ undersigned attorney as well as all other attorneys and staff members submitted their resignation. Therefore, the undersigned counsel (for defendants) has been attempting to manage the e-service as well as all other deadlines on her own until the new counselor(s) and staff is hired. Luckily, as of May 20, 2025, the Timeshare Law Firm has retained a new attorney who will finalize her transition into the firm on June 2, 2025.

Now Plaintiffs’ undersigned attorney is in the process of transferring such instant cases to a new attorney to finalize on June 2, 2025. As a result of this delay, on May 13, 2025, the Court issued an Order to Show Cause, directing Plaintiffs to explain why they had not filed the required Notice of Mediation. Therefore, Plaintiffs respectfully request that the Court discharge the Order to Show Cause issued on May 13, 2025.

Stephanie Parsons, Esquire, Attorney for Plaintiffs, The Timeshare Law Firm, L.L.C.

Melbourne Beach, FL 32951

New Volunteers are Always Welcome

Thank you to all who donate your time or treasure to further our cause. Contact us here if you would like to become more involved.

https://tarda.org/get-involved

Court Filings obtained from the Timeshare Law Library https://timesharelawlibrary.com/