Latest News

November TARDA Newsletter – MyResort Co Op Eliminates Perpetual Timeshare Contracts – Bridgett and Dawn’s Wyndham Experience – 15 Wyndham Resort Bankruptcies

Categories: Monthly Newsletters November 25, 2025

Our last Pod TV episode of Timeshare Solution or Surrender for 2025, Episode 86, aired on October 27. Beginning in 2026, the first 30 minutes of Timeshare Solution or Surrender will air live. The second 30 minutes will be a Timeshare Resource Center featuring past guests – industry experts and attorneys – offering short segments […]

Read MoreOctober TARDA Newsletter – Club Exploria Loses Class Action Illinois Robocall lawsuit, a $7,750 Summer Bay Special Assessment – Joan’s outreach to Shriners Hospital and the Pope

Categories: Monthly Newsletters October 28, 2025

New Club Exploria Timeshare Hostages Facebook Group https://www.facebook.com/groups/815849864717843/members We are grateful to PODTV’s Timeshare Solution or Surrender producers Marc Lee, attorney Nick Paleveda, and producer and co-host Kimberly Calhoun, for allowing our voices to be heard. Episode 85, October 20, discussed Club Exploria legal updates, and the $7,750 Summer Bay special assessment. There is also […]

Read MoreSeptember TARDA Newsletter: More on Arbitration – Holiday Inn “Disengages” with Silverleaf Resorts – an Update on My Resort Co Op

Categories: Monthly Newsletters September 30, 2025

Should I Self-advocate or Arbitrate? Holiday Inn Club Vacation to Remove Six Resorts from their Portfolio of Properties Steve and Cindy – A timeshare treasure turns to tragedy when a beloved Holiday Inn fixed-week in Panama City, that the family had owned for 30 years, unknowingly was converted to points. The family had no choice […]

Read MoreAugust TARDA Newsletter: The Explosion in Timeshare Exit Scams – Spawned by the Lack of Responsible Exit

Categories: Monthly Newsletters August 27, 2025

Just call your resort! It sounds good, but not much help thanks to the oral representation clause in which buyers agree they did not rely on anything a sales agent said. Despite this clause, also known as the non-reliance clause, some timeshare buyers have been able to resolve disputes. In our August newsletter, we share […]

Read MoreJuly TARDA Newsletter: Military Lending Act Update, Mexico timeshares and Cartels, the Latest Exit Company Lawsuit

Categories: Monthly Newsletters July 25, 2025

July was an active timeshare month. Included in this month’s newsletter are news reports about the lack of responsible exit for many timeshares, an investigation into Mexican cartels distributing Fentanyl and timeshare exit scams in the U.S. and Canada, and a court ruling on one of the Military Lending Act (MLA) lawsuits we have been […]

Read MoreTARDA Newsletter June 2025

Categories: Monthly Newsletters June 25, 2025

We have not been able to send a monthly newsletter since February – because of a good problem! Due to an increase in our volume of followers, we were unable to distribute the newsletter as we had been. This led to realization that relying on any volunteer to build, host and maintain/troubleshoot a website exceeds […]

Read MoreHow to Write a Timeshare Report

Categories: Advocacy June 25, 2025

By Irene Parker, MBA The first step to resolving a dispute is to compose a clear, concise report. Dig out your contracts, if you have them, and gather: The 5 Ws: What did you buy? A timeshare. No, what did you buy? Points or a week? If points, how many? Is it a timeshare or […]

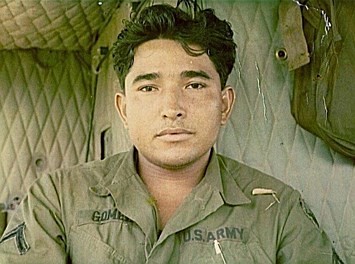

Read MoreIn May We Remember Veterans and Active Duty Service Members we have heard from who Sacrificed for Us and Legal Updates

Categories: Military May 28, 2025

Leo Gomez, two Purple Hearts, a Bronze Star, Vietnam Veteran August 3, 1947 – November 2, 2018 Leo reached out to us late September of 2018, with only 30 days left to live, worried about his wife being responsible for a $26,000 timeshare loan. He had been upgraded, told that because his resort had […]

Read MoreFebruary Newsletter – Legal Updates – Lingard v. Holiday Inn and Kirchner v. Wyndham Destinations

Categories: Monthly Newsletters March 29, 2025

PodTV’s February Timeshare Solution or Surrender show, Episodes 49 – 52 includes TARDA board members Jacob Bercu and Sherida Nett. Jake served many ye…

Read MoreMarch Newsletter – VOLQA – An Alternative to Perpetual Contracts – Legal Updates – ARDA Spring Conference – Three Very Different Hostages

Categories: Monthly Newsletters March 29, 2025

Florida resident Tom, pictured above, is a 23 year veteran of the Baltimore County Police Department. He organized a protest outside of ARDA’s Spring …

Read More